There are enormous advantages to owning gold. Adding a gold addition to your portfolio will considerably reduce your overall portfolio volatility, create a hedge against economic downturn, and add a vast economic juggernaut to your overall portfolio.

Investors planning for retirement, when you're considering investing in gold for a more long-term investment or buying gold into a self-directed IRA can help protect your assets and act in a manner that can assist in your assets raising its returns overall. Owning a modest amount of gold and silver within a balanced retirement investment portfolio can reduce your overall risk of the portfolio, helping to protect against reverses in the markets.

Precious Metals have become more and more accessible to retirement investors, due to the development of a wide range of investment products, such as a Precious Metals IRA, which investors can include in their retirement portfolio. The diversity of a retirement investment plan with a precious metal IRA that includes IRS approved precious metal products (such as gold, silver, platinum, and palladium) means that precious metals can be used to grow and create a wider selection of individual investment strategies and risk tolerances.

At Paradigm Gold Group, we feel that having a self-directed Precious Metals IRA that is backed by IRS approved precious metals (coins, bullion and bars and other approved precious metal products) is a rock solid diversification program to anyone’s retirement portfolio.

With so many items to choose when it comes to Precious Metals investing, choosing what is best to invest in? Is it exchange traded funds (ETFs), mining stocks, or physical gold?

Gold is a simple chemical element known by the symbol Au: a dense, easily shaped metal.

Its raw beauty and obvious value have made it a favored means of preserving wealth since the very beginning of human civilization.

The first gold coins first appeared around 600 B.C., though silver was preferred for trading purposes until at least the 1200s.

The gold we mine from the ground today most likely came to Earth via asteroid showers billions of years ago, so the amount of gold available above and below ground is surprisingly low. Picture a cube of metal that easily fits in a few Olympic-size swimming pools. This scarcity has contributed to its enduring value over the centuries.

Today, gold is a universally-recognized means for investors to preserve wealth and protect against financial calamity. Inflation, currency fluctuation, market collapse, societal unrest… these are the realities of modern life that gold can help alleviate.

But held in the hands, its raw beauty and obvious value have made it a favored means of preserving wealth since the very beginning of human civilization.

1. Sustained Demand: Demand for physical gold is rising among private investors, hedge funds, central banks and governments.

2. Scarcity: According to Goldman Sachs, there are only about 20 years of mineable gold reserves left underground.

3. Privacy: Your gold purchase information is not shared with any private or public entity. What you do with your gold is your business alone.

4. Diversification: Gold prices fluctuate in patterns that often run counter to other markets, making gold an ideal choice when seeking additional diversification.

5. Hedge Against Inflation: Precious metals can help preserve your purchasing power over time, especially during periods of high inflation.

6. ETFs vs Physical Gold: Some experts believe that the financial system could break down and cripple firms running ETFs, so they favor buying gold bullion either in coins or small bars for keeping in a safe deposit box.

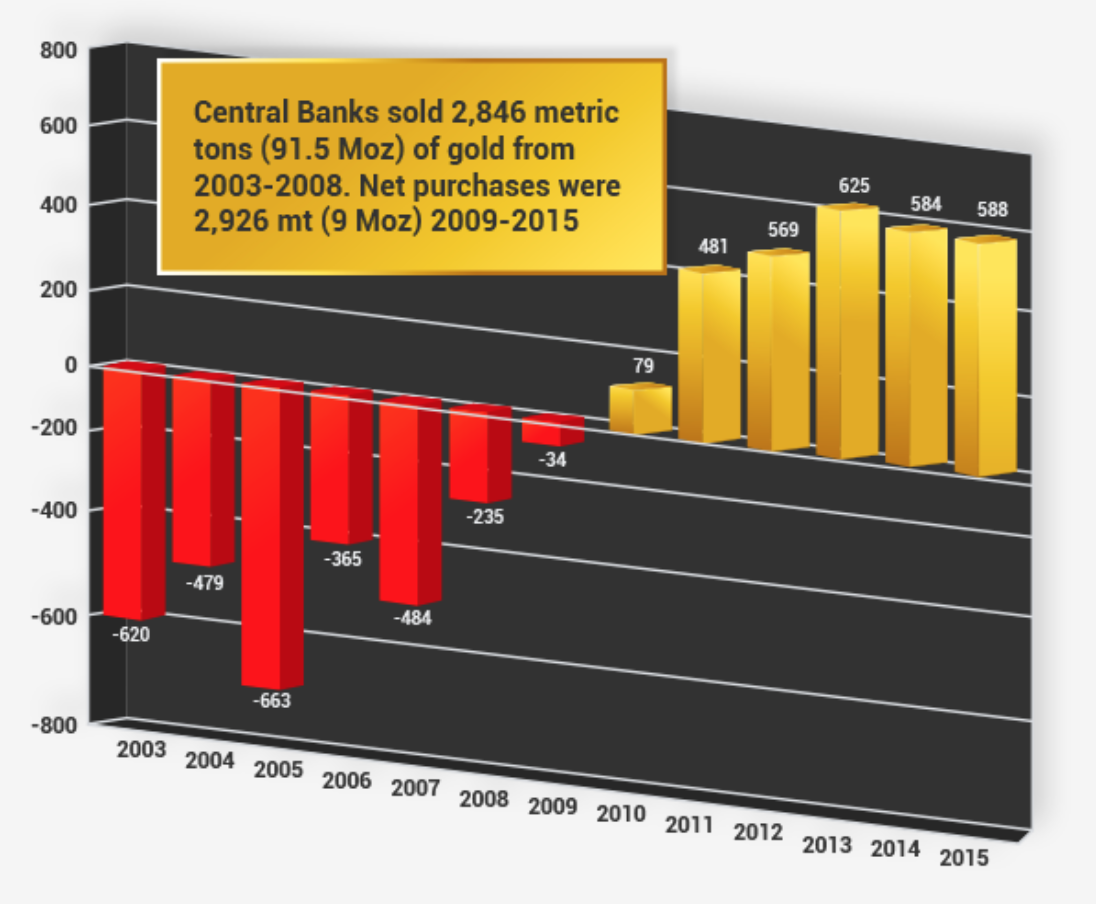

Central banks buy and hold gold for a variety of purposes, most notably as a way of diversifying their country’s own currency risk. Since 2008, these purchases have been substantial.

Since the supply of physical gold is remarkably small overall, this sustained heavy buying bodes well for the future direction of the gold price.

Gold stocks [mining stocks] generally include stocks and mutual funds include companies that prospect, mine, extract, and refine physical gold and silver.

Referred to as “paper gold”, gold stocks are similar to any other stock you would buy—you are simply betting on a company’s management and its ability to succeed and deliver consistent growth and profits. As with any company whose stock is publicly traded, there are many risks and potential pitfalls, which can expose investors to many levels of risk.

If the price of gold goes up, but the costs associated with running a mining company also increases, that company’s stock price could actually drop in value. Also, should the company itself be compromised, their share price could be significantly impacted.

Investing in individual stocks takes a lot of careful preparation, study, and research that is separate from the analyses of the overall gold market.

We recommend you do your own due diligence and consult with a registered financial advisor before making any investments in the stock market, gold stocks, ETFs or other derivatives of Precious Metals.

ETF shares are theoretically backed by the physical metal. Shareholders don’t own title to the metal itself but instead are effectively entrusting their wealth to the very large banks that serve as the primary custodian for the ETF’s bullion.

Many credible watchdog organizations already believe the major ETFs have partially backed some shares with derivatives instead of physical metals and are engaging in hidden leases, swaps, and commingling (risks that are even listed in some of the prospectuses for the ETFs)!

Finally, there are differences between the reporting requirements of ETFs or gold stocks and physical gold. Transactions and account openings must follow very strict reporting requirements of FINRA and the SEC. There are potentially no reporting requirements when buying or selling physical precious metals. This lack of paperwork makes the process more private and less burdensome than investments in gold ETFs.

ETFs and gold stocks don’t insulate you from the risks inherent in the financial system. Although they can be useful to high-frequency traders, they are no substitute for owning physical gold and silver.